Boot Without Borders: New Trade Data Reveal a Mosaic of Micro-Economies In Italy

Unveiling Italy's economic landscape: Dive into our latest trade data revealing the surprising diversity and distinct competitive advantages of regions from Milan to Sicily, shaping the future of local and global trade strategies.

This month we are thrilled to unveil a novel dataset from the Observatory of Economic Complexity that captures the intricate economic diversity and trade disparities among Italy's regions and provinces. Our detailed new subnational profiles traverses Italy's distinct macroregions—from the industrially dynamic North to the agriculturally rich and resource-abundant South and Islands. Each region presents a unique economic profile, revealing untapped opportunities essential for crafting strategic initiatives.

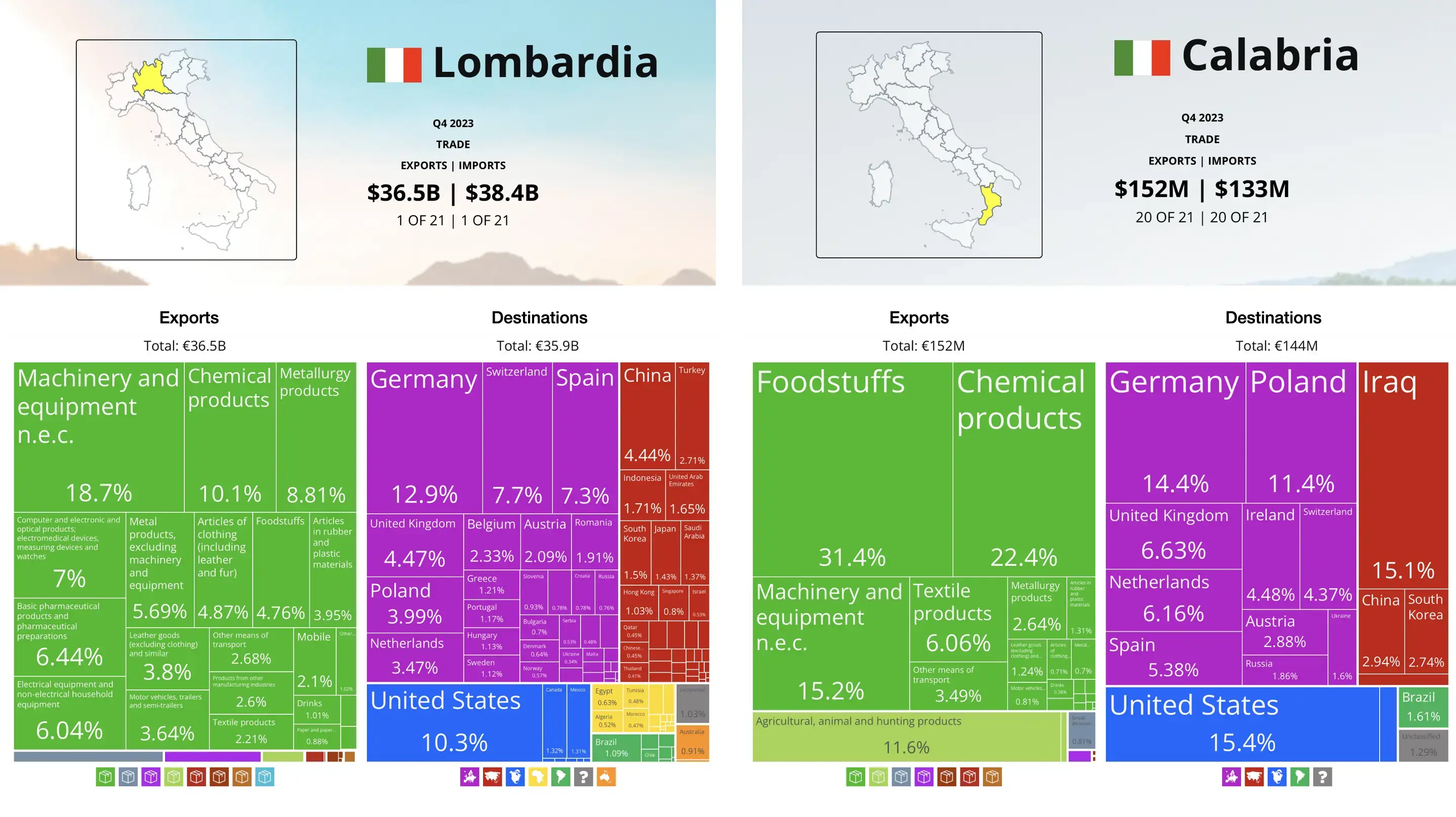

In Q4 2023, the data reveal dramatic contrasts in regional economic outputs: Lombardia's exports soared to €36.5.3 billion, affirming its role as a European economic powerhouse, while Calabria's exports were notably lower at €152 million. This disparity showcases Italy's wide economic spectrum, ranging from Milan's vibrant fashion and pharmaceutical sectors to Naples's solid manufacturing base and Sicily's vital contributions in crude oil production and agriculture.

These insights equip policymakers, businesses, and economic planners with the necessary information to craft targeted strategies that enhance regional strengths and address economic imbalances, fostering a more nuanced understanding of Italy's complex economic landscape.

We’ve incorporated the hierarchical framework of macroregions, regions, and subnational geographies, and broken out datasets for each frame. Five macroregions—Italia Nord-occidentale, Italia Nord-orientale, Italia Centrale, Italia Meridionale, and Italia Insulare— are at the top. Those five are then divided into 20 regions: Lombardia, Lazio, Sicilia and the rest, plus an additional unspecified category. Further division reveals a granularity total of 112 subnational areas where Milano Napoli and other cities and towns fall. This structure allows easy investigation of local conditions to explain anomalies or reveal hidden opportunities.

Putting Very Different Eggs in One Basket: Regional Comparative Advantage

Regional Comparative Advantage (RCA) is a crucial metric used to pinpoint sectors or activities where a country or region excels significantly compared to others. This measure helps in identifying the unique strengths and specializations of different geographic areas. By analyzing RCA, stakeholders can assess the efficiency and impact of various industries, understanding their true contributions to the national economy.

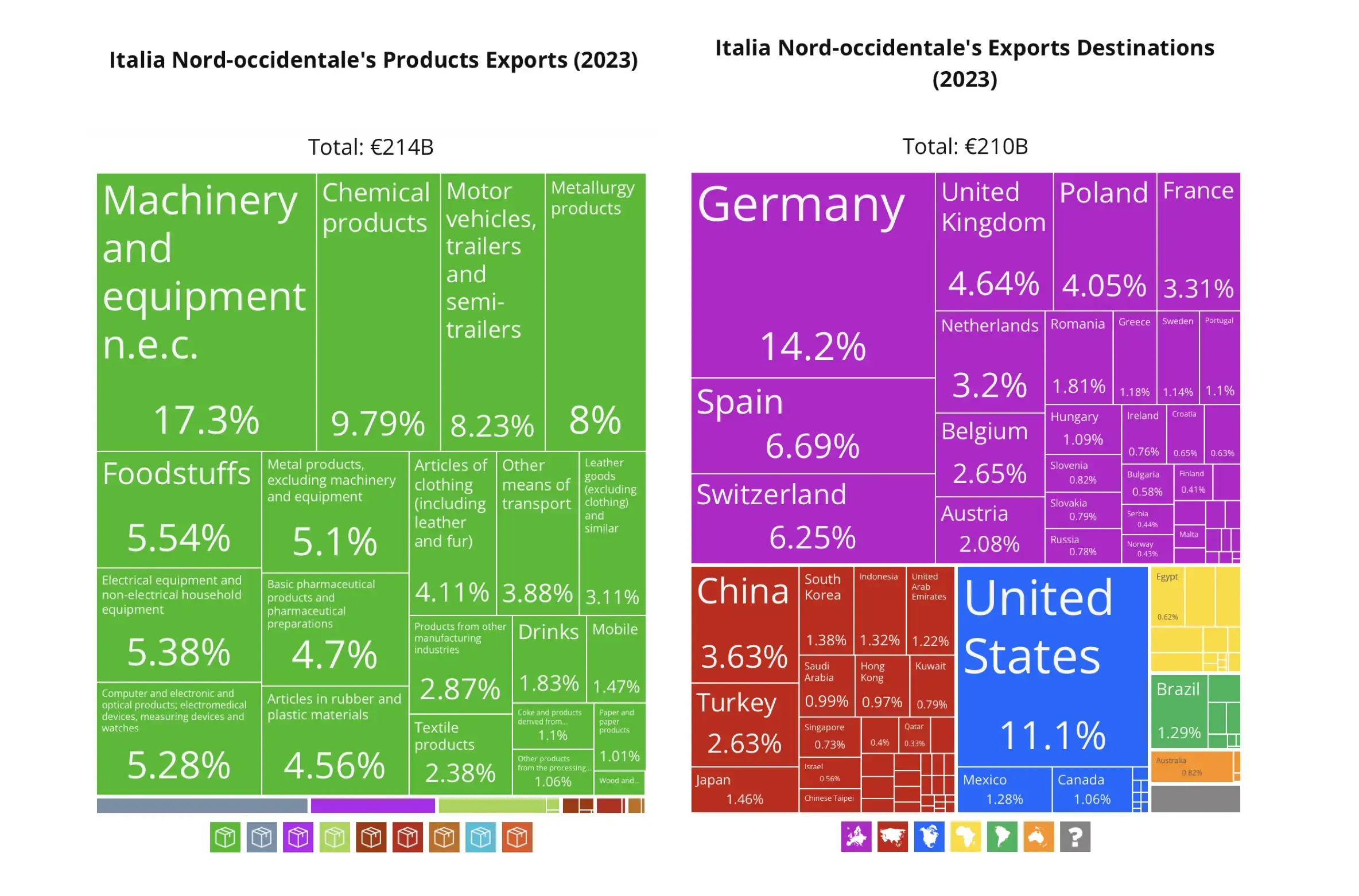

Lombardia and Piemonte, excel in motor vehicle exports, which reached €25.09 billion in 2023, accounting for 55.55% of Italy's sectoral exports. The northwest is also committed to sustainable manufacturing, with an RCA of 2.61 in recycling and material recovery. Total trade in Italia Nord-occidentale increased from €181.5 billion in 2022 to €210.3 billion in 2023, driven by Pharmaceuticals and Electronics, with Germany and the United States as primary markets.

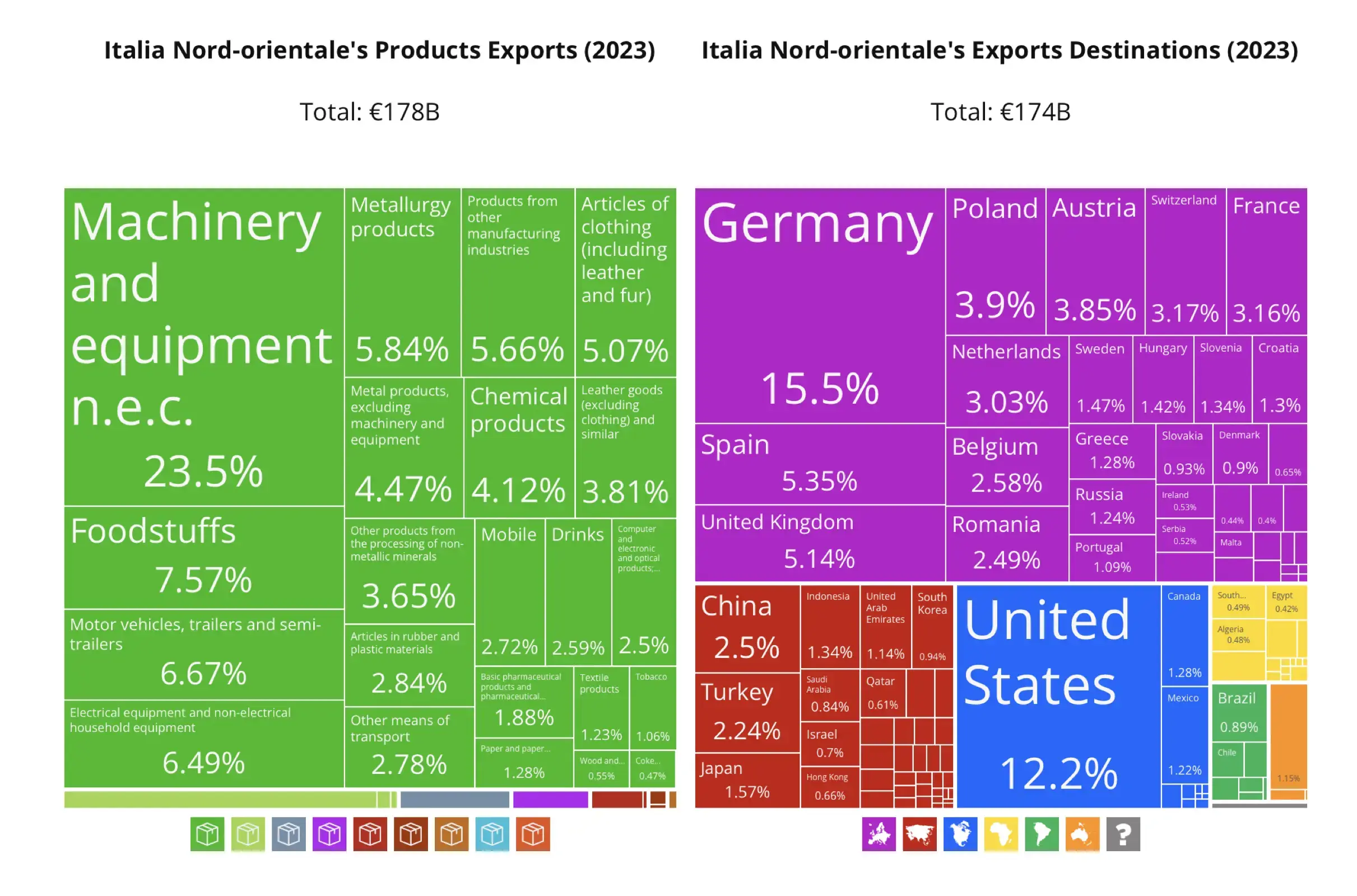

Veneto and Friuli-Venezia Giulia, to the east, exported €19.18 billion in general-purpose machines and has a specialization in terracotta building materials, indicative of expertise in both high-tech and traditional industries. Trade rose from €153.6 billion to €174.4 billion, with Textiles and Food Products the leading exports to France, Switzerland, and Spain.

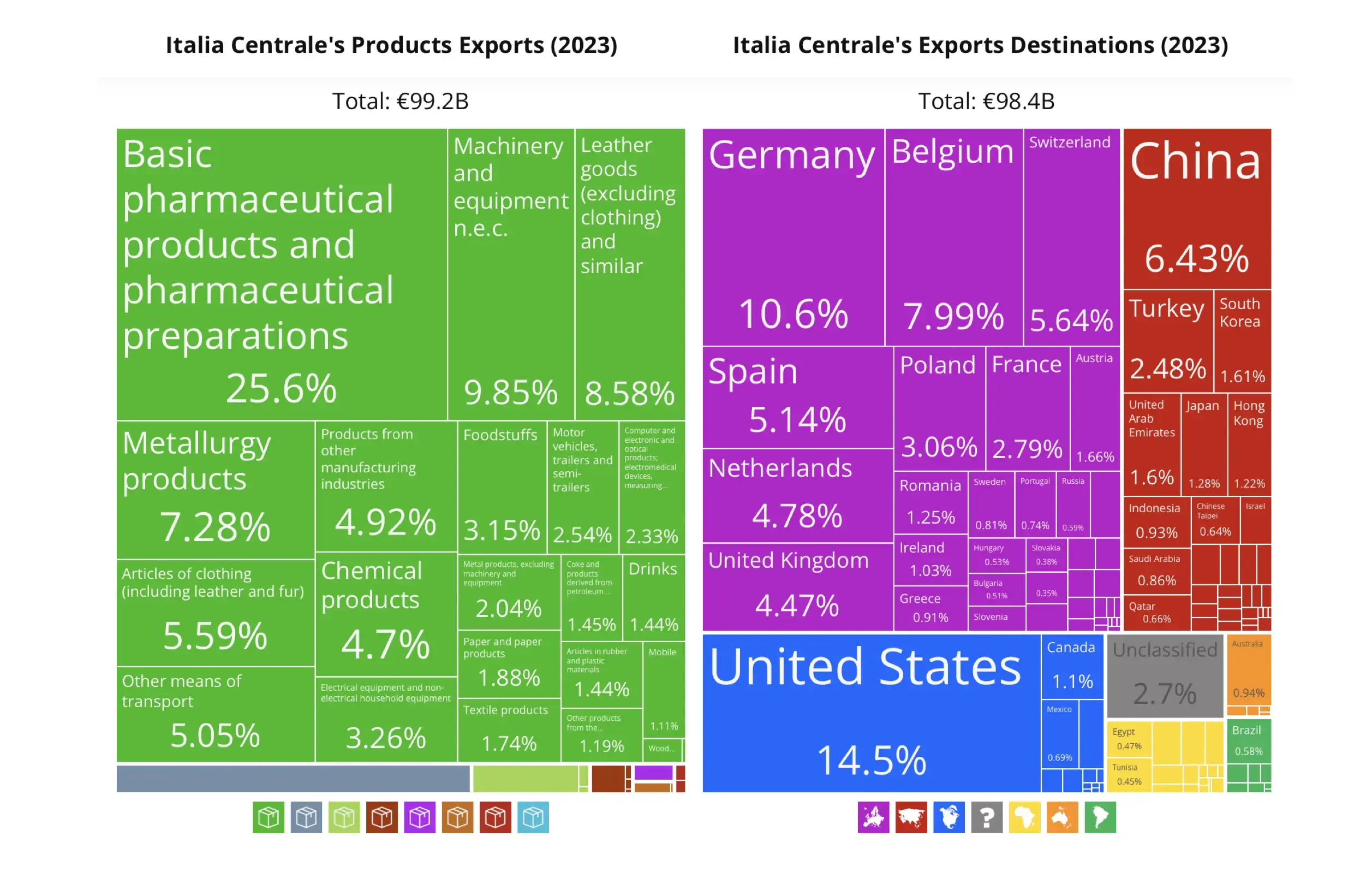

Pharmaceuticals are the driver of exports here. Valued at €39.13 billion in 2023, Central Italy controls well over half of the national pharma output at 53.10% with an RCA of 3.43. Lazio and Toscana are the biggest regional players but volatile medical markets are hedged with Toscana shipping classic stone products. With a portfolio of exports that grew in value from €91.8 billion to €98.4 billion, Tuscan stone was bolstered by Leather Goods and Machinery, mainly bound for the United Kingdom and France.

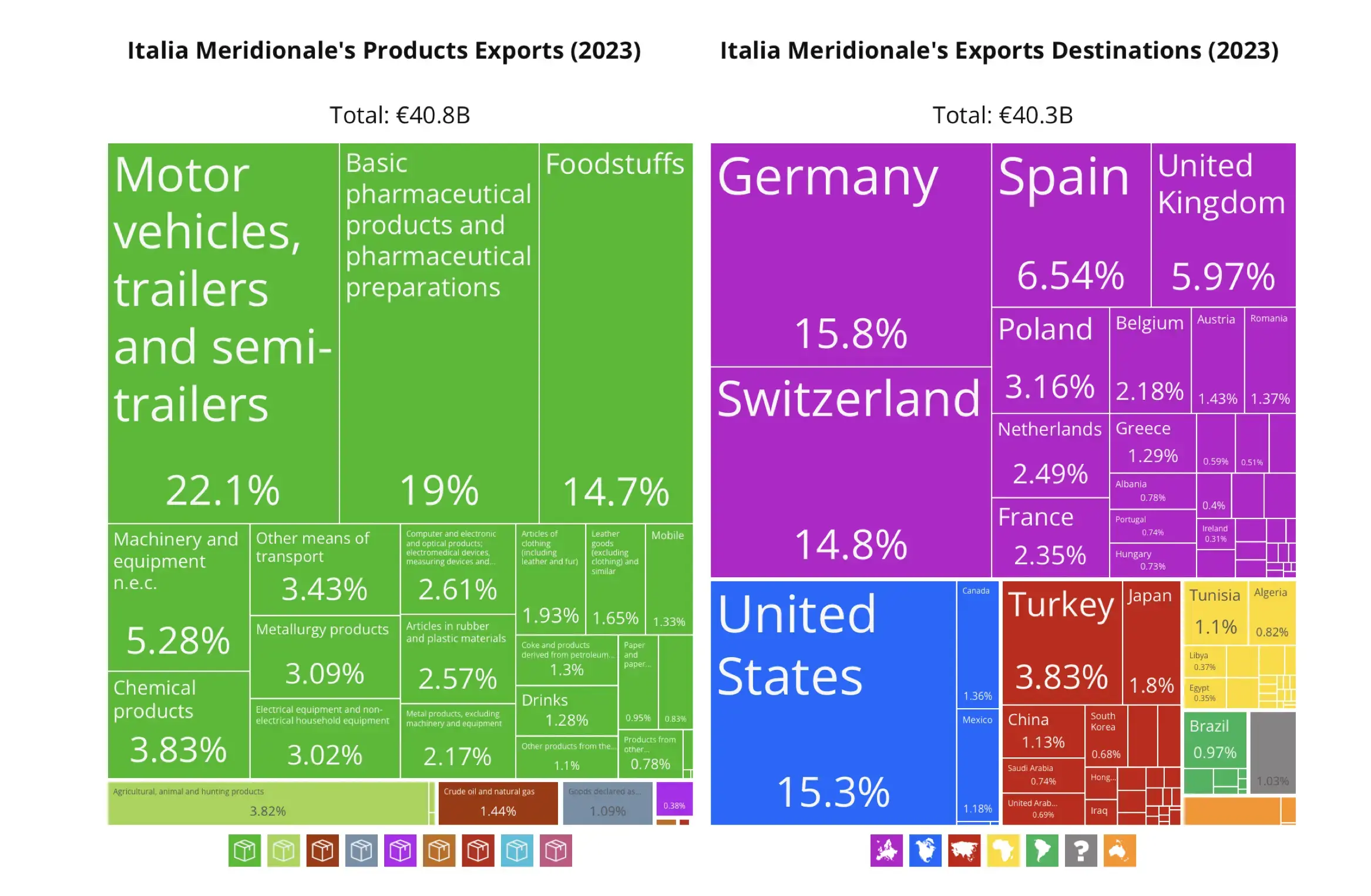

The meridionale region also has a piece of the pharma trade with €9 billion out of total exports that grew from €28.9 billion to €40.3 billion. A high specialization in driving trucks shows another diverse region. Campania and Puglia are influential in pharmaceuticals and automotive sectors, focusing on markets in the United States and Northern Europe.

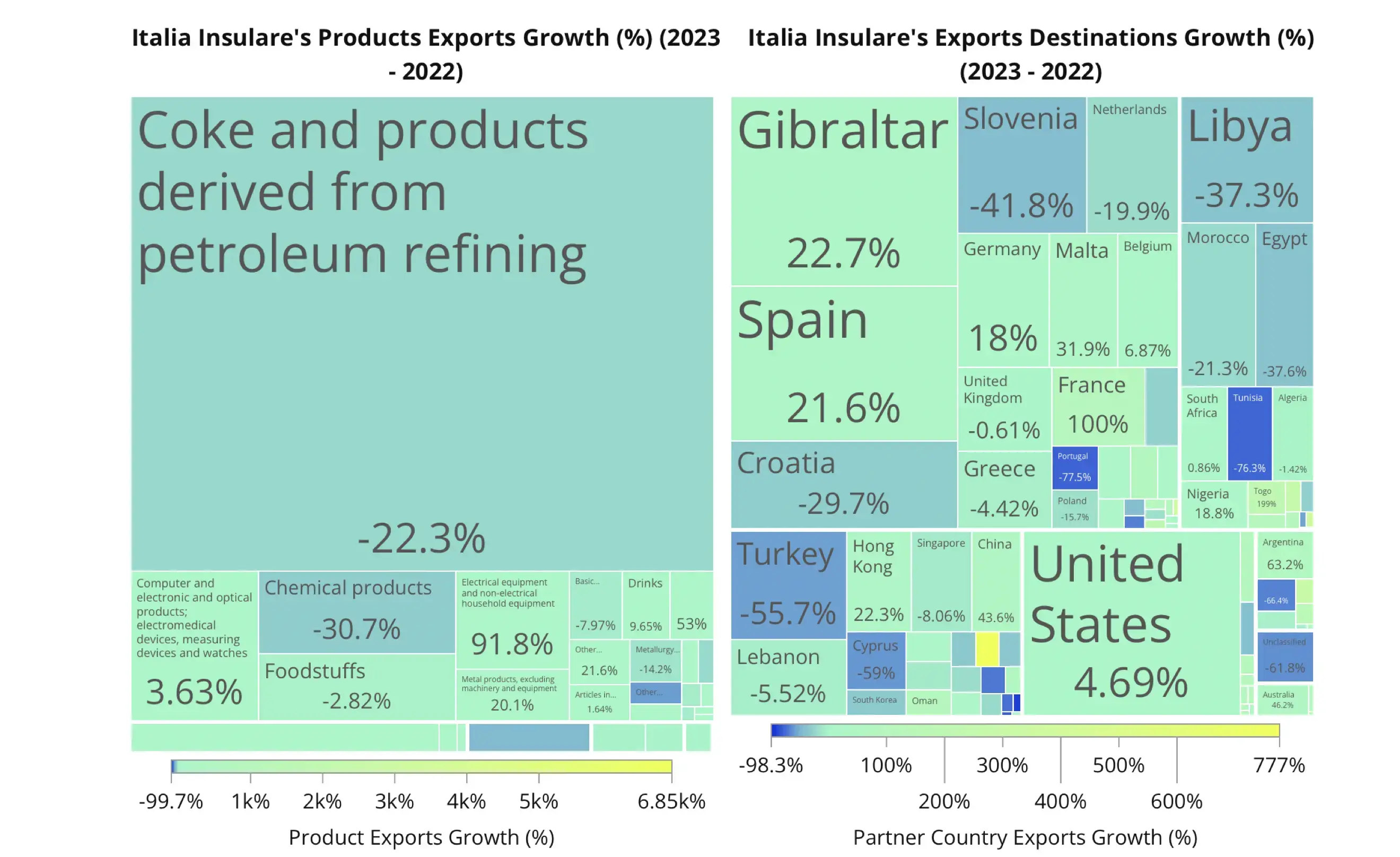

Italia Insulare, significant in the crude oil sector, exported €22.43 billion, comprising 62% of Italy's total. With an RCA of 14.03, Sicilia and Sardinia play a critical role in energy. However, trade fell from €21.8 billion to €18.5 billion, with a decline in multiple sectors including Miscellaneous Goods.

These regional profiles illustrate diverse strengths across Italy's macroregions—from advanced manufacturing and sustainability in the North to pharmaceutical leadership in Central Italy and resource-rich opportunities in the South and Islands. Recognizing these dynamics and leveraging the comparative advantages of each region is crucial for stakeholders looking to find lucrative partnerships in Italy's complex economy. As global market conditions evolve, OEC data will help importers and exporters measure each region’s ability to adapt and capitalize on their unique strengths.

Recent Export Trends In Italy

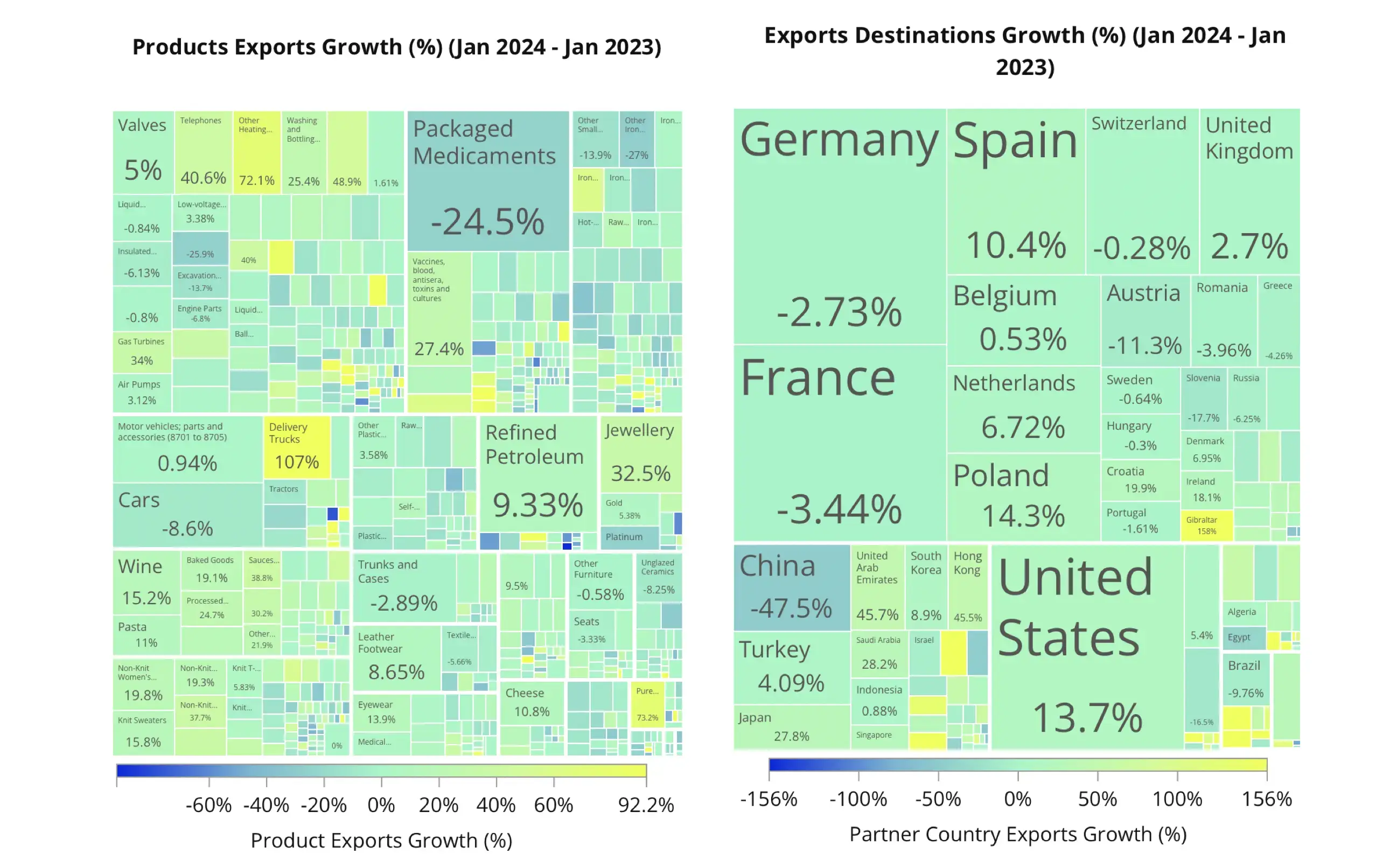

In January 2024, Italy’s exports were $44.7 billion (€42.5 billion), a slight increase from the previous year.

- Compared to three months earlier, exports were down by $8.41 billion (-15.8%).

- Over a six-month period, the decrease was $6.1 billion (-12%).

These short-term declines are at odds with a solid longer term growth trend. Year-over-year growth was $670 million (1.52%) and the two year trend weighs in at a significant $6.19 billion (16.1%), indicating a solid trajectory over the long term.

- Germany: Exports in January 2024 reached $6.12 billion (€5.82 billion), showing a month-on-month decrease of 2.73%. This decline is part of a longer-term downward trend observed over the past few years.

- France: Exhibited a decline with January exports at $5.07 billion (€4.82 billion), down 3.3% from the previous year. The contraction was led by a decrease in refined oil exports.

- United States: Faced a sharp increase in January 2024, with exports growing by $560 million (13.7%) from the previous year. This growth was driven notably by sectors such as Other Heating Machinery, which saw an extraordinary growth of 851%, and Packed Medicaments, which increased by 122%. This upward trend is consistent with broader positive developments in trade relations with the U.S. over recent years.

- Delivery Trucks: This sector showed extraordinary growth, especially in Algeria, Poland and France, where exports surged to $76 million in January 2024, marking an annual increase of 126%.

- Wine: As the top global wine exporter Italy has become an aggressive climate watcher and skillful sustainability player. Piedmont and Lombardy are adjusting harvest times and introducing late-ripening grape varieties to maintain wine quality. In Tuscany, frost prevention candles are a partial solution and challenges remain to preserve traditional wine quality. Sicily and Basilicata, are adapting vineyard practices due to increased heat and disease risks, developing disease-resistant vines. The revival of ancient grape varieties is another tool for sustaining Italy's wine legacy amidst climate challenges.

- But climate stress has produced volatility in the wine sector. January 2024 saw wine exports decrease to $553 million (€526 million), down 6.38% from December 2023. Can Italy maintain its leadership position in wine exports? So far the long term view is yes.

New OEC datasets can provide early warning and advanced monitoring of nuanced export trends and market dynamics by raising the curtain on the interconnected regional economic ebb and flow. Understanding and responding to these trends is a model for analyzing other complex economies in the global trade galaxy.

Conclusion

The detailed trade data from the Observatory of Economic Complexity delivers a high resolution image of Italy's macroregions with strategic insights for policy-making. From the advanced manufacturing sectors in the North to the resource-rich South and Islands, each region possesses competitive advantages that can stimulate national economic growth. Utilizing this rich data will help stakeholders develop targeted economic strategies, addressing disparities and enhancing Italy's sustainable economic future.